who claims child on taxes with 50/50 custody pennsylvania

Who Claims the Child With 5050 Parenting Time. Section 152 This usually means the mother because she most often gets primary physical custody.

Do I Have To Pay Child Support If I Share 50 50 Custody

Find the best ones near you.

. Please beware that if the custodial parent releases the exception the custodial parent may not claim the Child Tax Credit. By Fox Rothschild LLP on January 23 2008. Who claims the minor child on their income tax in pennsylvania when the parents were never married and have a 5050 - Answered by a verified Tax Professional.

The court has ruled joint. California law states that in split 5050 child custody agreements the parent with the higher income can claim the. Transferring Tax Credit to Your Ex in a 5050 Custody Arrangement.

It is the parent who spends the most. This can lead to some confusion over whether either. The one who had custody for more than 12 of the year can claim the child as a dependent child care expenses earned income tax credit and if eligible Head of Household.

Generally Pennsylvania law provides that the parent who has primary physical custody of the child is entitled to claim the. Having a child may entitle you to certain deductions and credits on your yearly tax return. You who can claim a child ontaxes in a 5050 custody - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website.

For a confidential consultation with an experienced child custody lawyer in Dallas. The custodial parent as defined by the IRS claims the child tax credit in a 5050 division. By continuing to use.

If only one of you is the childs parent the child is treated as the qualifying child of the parent. Who claims child on taxes with 50 50 custody in PA. Who Claims a Child on US Taxes With 5050 Custody.

Child Custody and Taxes. By Aaron Weems on November 1 2012. Tax issues are an important component of equitable distribution cases and the Pennsylvania support code specifically allows the Court to.

However if the child custody agreement is 5050 the IRS allows the parent with the. In the event of. But if you dont suspect anyone who could have claimed the dependent your dependent may be a victim of tax identity theft.

The Internal Revenue Service IRS typically. Who claims child on taxes in case of joint 50 50 custody. Pennsylvania allows for parents to share custody of a minor child after a divorce and in some cases that custody is split equally 5050.

In a leap year that is a year that has 366 days parents who have 5050 custody will likely have the exact same number of overnights. Avvo has 97 of all lawyers in the US. How Pennsylvania Courts make Child Custody Decisions.

In a joint custody agreement the custodial parent can claim the child as a dependent on their tax returns. Equal The parent who qualifies as the custodial parent under federal tax law is the one who claims the children as. When you have 5050 custody who claims the child on taxes.

In this case the child tax credit is. How the IRS Decides Who. Again the rule for claiming children on your taxes is relatively simple.

Who claims child on taxes with 5050 custody pennsylvania. Understand the common factors Pennsylvanias judges use when making child custody decisions. But if the father furnishes over 50 of the childs support he is entitled to the.

70 30 Custody Visitation Schedules Most Common Examples

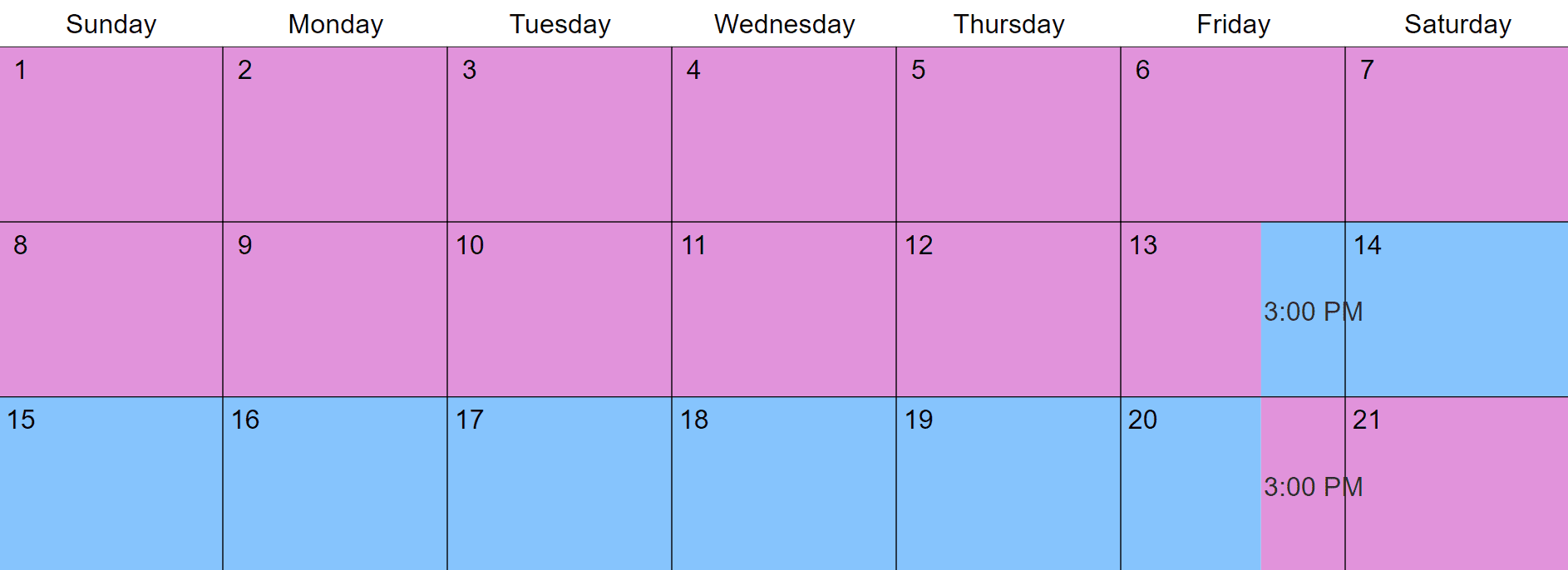

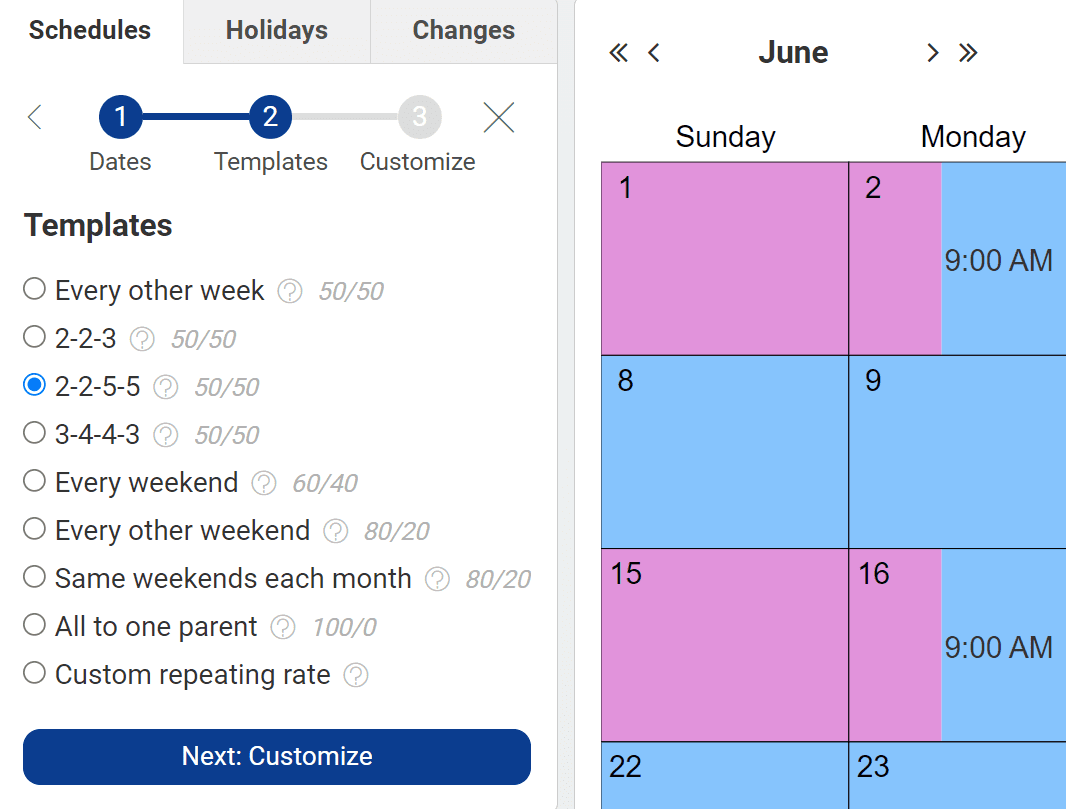

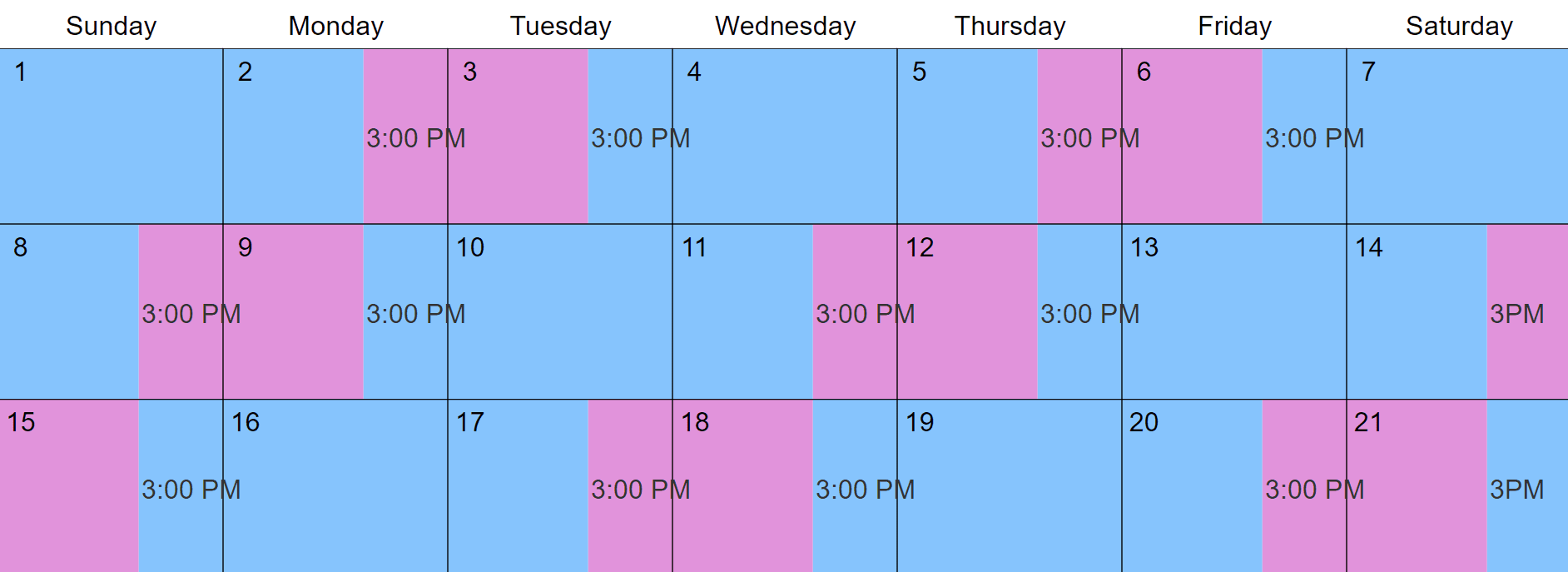

What Does A 50 50 Or Joint Custody Agreement Look Like

What Happens When Both Parents Claim A Child On A Tax Return Turbotax Tax Tips Videos

Florida 50 50 Parenting Plan 50 50 Custody And Child Support

70 30 Custody Visitation Schedules Most Common Examples

New Jersey Child Custody Laws Everything You Need To Know

Custody Does Matter When Filing Your Taxes 2020 Update Andalman Flynn Law Firm

Who Claims A Child On Taxes With 50 50 Custody In California Her Lawyer

Child Custody In Pennsylvania Which Agreement Is Right For You

Child Custody In Pennsylvania Which Agreement Is Right For You

How Child Support Is Calculated In Pennsylvania Cooley Handy Blog

70 30 Custody Visitation Schedules Most Common Examples

What Does A 50 50 Or Joint Custody Agreement Look Like

.png)

Is Property Split 50 50 In A California Divorce

Do I Have To Pay Child Support If I Share 50 50 Custody

Florida 50 50 Parenting Plan 50 50 Custody And Child Support

5 2 2 5 Parenting Schedule Joint Physical Custody Williams Divorce